What's On

The Lord Mayor of the , Alastair King, has today…

Going Out

Thames Rockets has launched the £1.6m Rocket Rebel, the largest, fastest…

Reviews

Romanian The kitchen is extremely excellent and one of the…

Latest Articles

The best gifts you can buy for gamers” datanexthead/>nAs a consumer journalist, Pete has reviewed hundreds of products…

We’ve been spoilt for choice in the European train travel department recently, haven’t we? A whole host of…

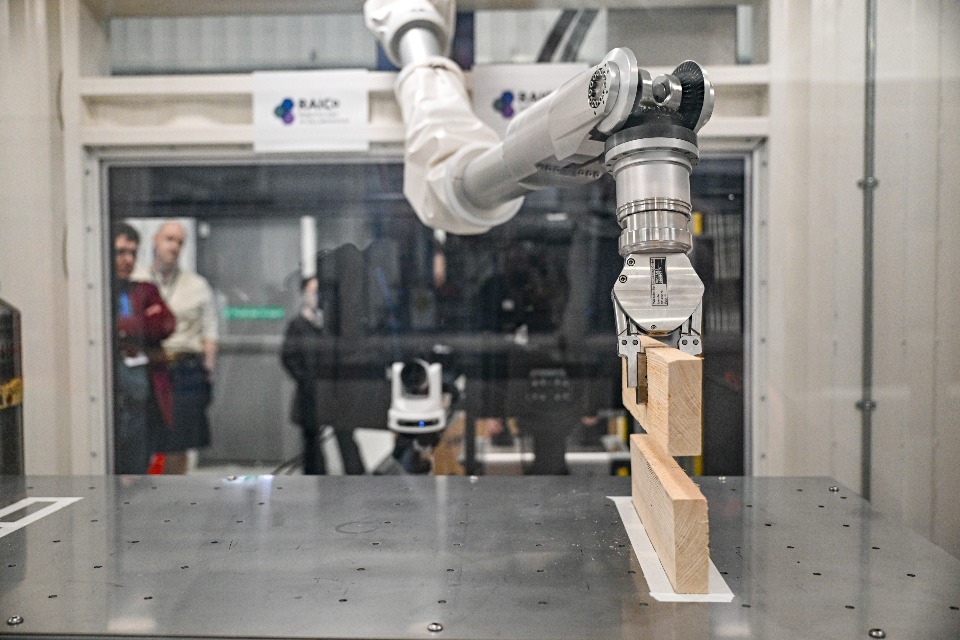

The week-long workshop showcased best practice in innovative technologies to support nuclear decommissioning. Held at Energus in West…

Pizza Express has announced that it has agreed a refinancing deal with over 97% of its existing bondholders.…

Ian Murray lays wreath with survivor in Manhattan as Edinburgh Royal Military Tattoo pay moving tribute at memorial…

The UK has bolstered its support to Myanmar earthquake, allocating a further £10 million to the ongoing humanitarian…

The best photography gifts” datanexthead/>Simon specialises in testing the latest smart gadgets, home entertainment gear, headphones, speakers, portable…

The British High Commission is proud to announce winners for the fourth annual Ambassador for a Day (AfD)…

In Spotlight

Louise Smyth CBE, Chief Executive of Companies House and Registrar…