Created by German entrepreneur and billionaire Michael Gastauer as an aid to promote financial inclusion and reduce the frustrations of cross-border transactions, Black Banx has become a leader in its own right. Having amassed over 45 million customers in less than a decade, the fintech company’s comprehensive list of services has attracted clients in over 180 countries, from individuals to small businesses. But what exactly is on offer?

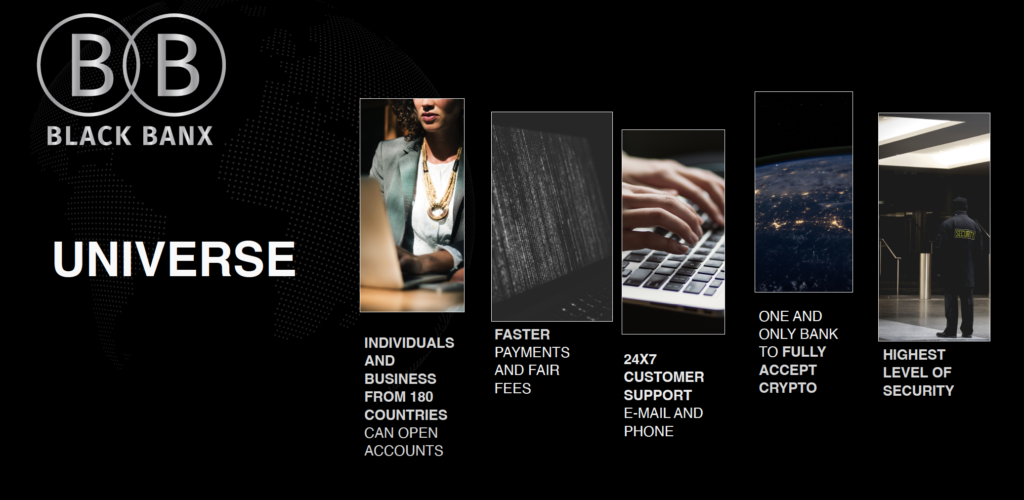

Access to financial services is a core element of the Black Banx ethos. Committed to facilitating the free and instant flow of money globally at a fair price, the digital bank hopes to provide a financial service platform that helps to grow economic markets by connecting people and businesses around the world via online platforms and mobile phones.

In a past interview, CEO Michael Gastauer explained Black Banx’s foundations and mission: “We continue to build a global, borderless, customer focused platform which feels personal to everyone and will serve as a trusted tool to manage and grow customer funds. We provide business and personal customers with banking access without restrictions based on nationality, country of residence, religion, amount of funds held or transferred.

“Our aim is to increase the simplicity of online banking, dramatically reduce transaction times and achieve financial inclusion. We serve people and businesses in well established economies, as well as the underbanked in countries which have less access to the financial system or where governments prevent people from freely participating in the global economy. We have substantial presence in countries across Asia, Latin America and North America, as well as in the Middle East and Europe.

“Through our business and personal accounts, we allow customers to utilise carefully selected, best in class global banking networks to process money without any transaction limits. This enables them to send and accept local and international payments almost instantly, and hold or manage funds in multi-fiat and cryptocurrencies.”

Who is Michael Gastauer?

The billionaire innovator is one of Germany’s richest men. Having experienced for several years the flaws of cross border banking, account opening in foreign countries and international wire transfers, Gastauer decided in mid 2013, to create an online banking solution to revolutionise the traditional banking industry.

He hired a team of senior software experts, explained his vision and asked them to build an online platform that could offer as a core functionality, instant account opening for private and business clients worldwide and global real time fund transfers in multiple FIAT and crypto currencies. After successfully testing an early version of the platform (initially launched under the project name WB21), Gastauer founded Black Banx.

His previous endeavours enabled Gastauer to provide the necessary financial support for the growth of Black Banx. In 2014, Gastauer started to strategically invest his resources into his digital banking platform. According to various public sources, Gastauer invested between 2014 and 2018, US$380m via his Family Office to build Black Banx.

Alongside being a highly successful entrepreneur, Gastauer is committed to giving back to the community, investing in green energy projects, and supporting animal causes.

In February, the Black Banx CEO set up a $1.5bn nature fund through his family office. The nature fund was created in an effort to combat the mass extinction of species and help meet the Global Biodiversity Framework target of protecting 30% of the world’s land and oceans by 2030.

History of Black Banx

2024: Q1 45m + customers, $639m profit before tax, $2.1bn net revenues

12/2022 20m+ customers, $1.1bn revenue, 3,020 employees

06/2022 15m+ customers, $420m revenue, 2,100 employees

2021 Launch in Japan, reaching increasing customer base to 12m customers 2020 Office launched in China, increasing customer base to 10.5m customers

2019 Expansion with offices in UAE and South Africa, increasing customer base to 8m customers

2018 Offered private and business accounts in 28 FIAT currencies to 5m customers. Launched a fully fledged crypto currency trading with BTC and ETH as crypto currency. Office opened in Canada.

2017 Expansion with offices in Singapore, Brazil, India and Russia, increasing customer base to 3m

2016 Expansion with offices in USA, UK and Hong Kong, offering products in 18 currencies, offering crypto currency as a deposit method, increasing customer base to 1m customers

2015 Founder Michael Gastauer and his team launched Black Banx offering private and business accounts for 180 countries, with 200,000 customers

With record breaking figures, Black Banx, led by Michael Gastauer shows no signs of slowing down. Instead, it continues to be a core player in the fintech industry.