Introduction

Georgi Bedenham, an actuary from the Government Actuary’s Department (GAD), is co-author of a new report, Planetary Solvency – finding our balance with nature. The report brings together risk management techniques, the latest climate science, and systemic risk assessment methodologies.

Planetary Solvency is the latest in a series of papers focussing on climate risk from the Institute and Faculty of Actuaries (IFoA) and the University of Exeter. It highlights how risk management techniques, informed by the latest science, can help to guide policy decisions to support future prosperity.

Risk of Planetary Insolvency

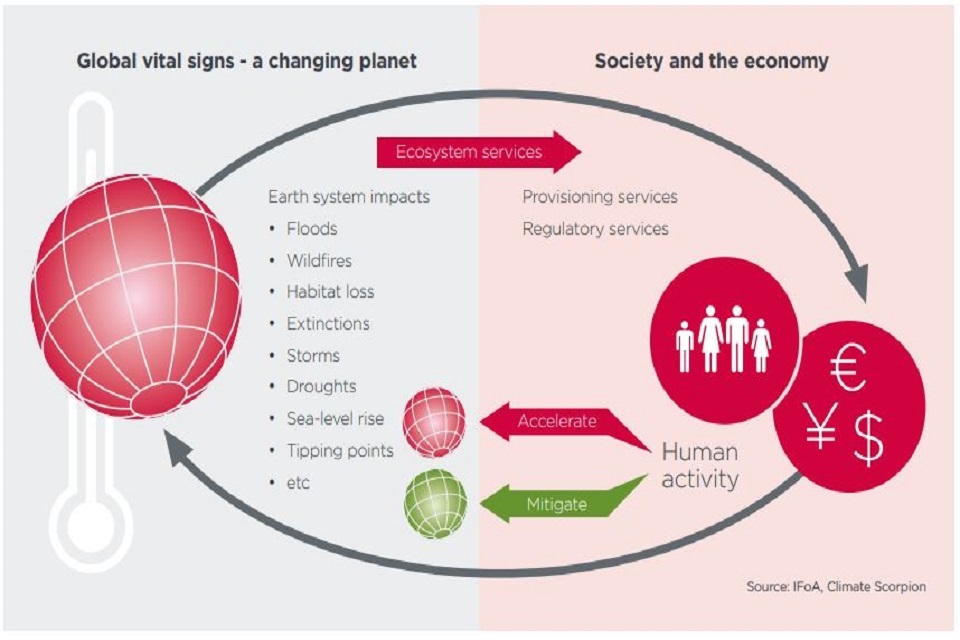

Planetary Solvency is defined as ‘managing human activity to minimise the risk of societal disruption from the loss of critical support services from nature’. It assesses the ability of our planet now, and in the future, to support human society and the economy.

The report concludes there is an increasing risk of ‘Planetary Insolvency’. In other words, an increasing risk of severe societal and economic disruption caused by a breakdown in critical ecosystem services. This could include the provision of food and water and regulation of the climate. Therefore, catastrophic or extreme impacts are plausible unless decisive action is taken to mitigate climate and nature risks.

Source: iStockPhoto

Five key recommendations are put forward to mitigate the risk of ‘Planetary Insolvency’:

- implement Planetary Solvency assessments to provide clear global systemic risk information for realistic and effective global risk management

- set Planetary Solvency limits that respect planetary boundaries, including revisiting climate goals and developing metrics to monitor planetary health

- enhance governance structures to formalise Planetary Solvency and provide transparent, easy-to-digest assessments for relevant bodies and the public

- build policymaker capacity on systemic risk management, enhancing understanding of the risks and interdependencies, and embedding risk outputs within current risk management processes

- take action to mitigate risk through incentives and policy design, as well as exploring options to limit global warming

Source: Institute and Faculty of Actuaries (IFoA)

The Earth provides ecosystem services, such as provision of food and water and regulation of the climate, that support our society and the economy. Human activity has a profound influence on the Earth’s natural systems. This interaction is having a significant negative impact, driving extreme weather events and habitat loss, and risks pushing our planet into a much less habitable state.

Decision-useful framework

The report introduces illustrative outputs for Planetary Solvency risk assessments in the type of format that might be provided to a risk committee.

This includes an assessment of risk appetite alongside a risk dashboard. It sets out the current risk position and trajectory across the different dimensions of:

- climate

- nature

- society

- the economy

Actuaries traditionally use their risk management expertise to help decision-makers understand the risk of financial insolvency.

Planetary Solvency applies these techniques to the Earth system (the complex suite of systems such as the atmosphere and biosphere that create the conditions we live in on Earth) to ensure we minimise risks and keep activities within planetary boundaries.

Minimise risks

Realistic risk assessments of Planetary Solvency would provide useful risk information. This could enable policymakers to make complex decisions to help steer human activity safely.

GAD actuary Georgi Bedenham has continued her contribution to IFoA climate papers in this latest collaboration between actuaries and Earth System scientists. “Following the publication of Climate Scorpion last year, I am delighted to be continuing my involvement in this series of IFoA papers on climate risk.

“This paper provides a new way of framing our approach to managing the systemic risks associated with climate change and nature loss. It uses traditional risk management techniques in a creative way.

“This approach enables us to consider the boundaries within which society can prosper and what actions need to be taken now and, in the future, to address these risks.”